Watches of Switzerland (LSE: WOSG) shares have experienced a huge pullback over the last 18 months. At the start of last year, they were trading near 1,500p. Today however, they can be snapped up for around 730p.

So why has the share price fallen? And is this a great opportunity to invest in the luxury watch retailer?

What’s behind the share price fall?

During the coronavirus pandemic, the luxury watch market experienced a massive boom. Demand for high-end watches (Rolex, Patek Philippe, Omega, Cartier, etc) soared because:

- White-collar workers (most of whom didn’t lose their jobs) were cashed up, and the only thing they could spend their money on was goods.

- There was an explosion in watch-related social media (YouTube, Instagram, TikTok, etc).

- People were feeling wealthy due to stock market/property gains.

- Crypto investors were looking to diversify into hard assets.

- Harder-to-obtain watches started increasing in value significantly.

Demand was so high that it was virtually impossible to buy even an entry-level Rolex from any retail store in the world without going on a waiting list.

Post Covid however, demand for luxury watches is not quite so high. Today, there is a massive shift in spending from goods to experiences. At the same time, a lot of people now have less cash to spend on discretionary items due to the fact that mortgage rates are much higher than they were two years ago.

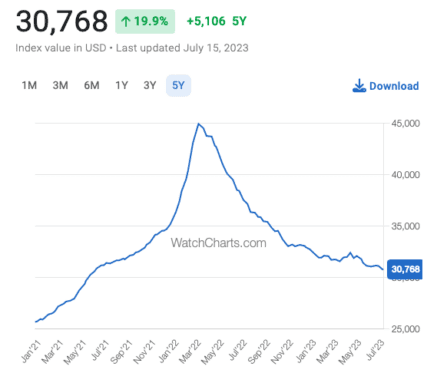

The drop in demand is illustrated by prices in the second hand watch market. Just look at the WatchCharts Overall Market Index, which tracks the prices of 60 watches taken from the top 10 luxury watch brands by transaction value.

Source: watchcharts.com

The chart clearly shows that prices in the second hand market have fallen, which indicates that demand for luxury watches has cooled. This lower level of demand explains why the Watches of Switzerland share price has come down dramatically over the last 18 months or so.

Worth buying now?

After the big share price decline, the stock does look quite interesting to me.

While demand for luxury watches has clearly fallen, it’s still robust. This is illustrated by the fact that for the year to 30 April, Watches of Switzerland generated constant currency revenue growth of 19% (and it expects growth of 8-11% this financial year). It’s also illustrated by the fact that it’s still impossible to buy a new stainless steel Rolex watch in a retail store without going on a waiting list.

Meanwhile, the company’s valuation is now quite reasonable. For the year ending 30 April 2024, analysts expect the retailer to generate earnings per share of 53.7p. That puts the stock on a forward-looking price-to-earnings (P/E) ratio of about 13.3, which is only a tad higher than the market average.

Obviously, the big risk here is economic conditions. A weaker economy isn’t likely to impact demand for watches from the super wealthy too much. But it could have a negative effect on demand from other segments of the population. If people are worried about losing their jobs, for example, they are less likely to go out and spend £5k on a new watch.

Overall however, I feel the risk/reward skew at the current share price is quite attractive. I think the stock is worth a closer look right now.